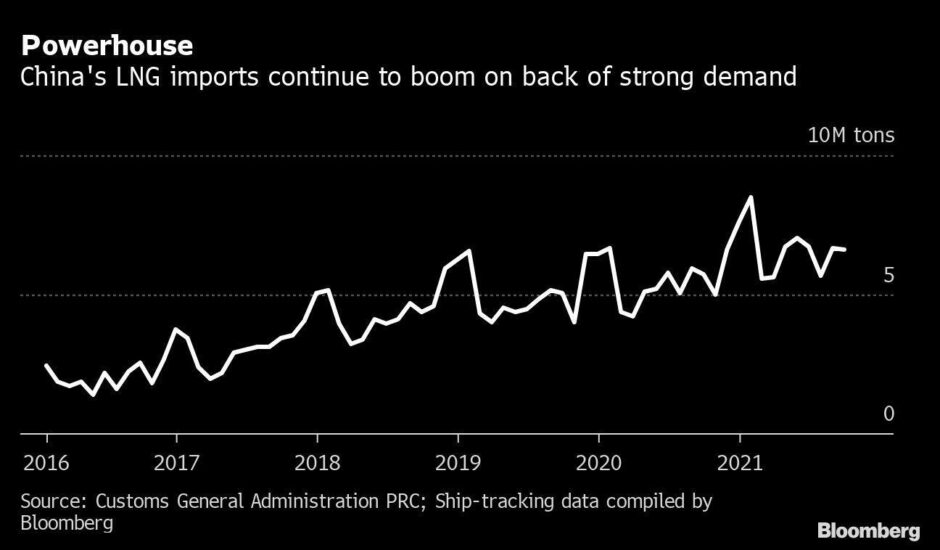

China is urging its liquefied natural gas (LNG) importers to procure more supply to fix its energy crisis, while providing little financial support for firms paying record-high rates for the super-chilled fuel.

The government isn’t providing enough subsidies for recent purchases, making it difficult for the nation’s smaller gas distributors to meet the request to secure enough fuel before winter, according to traders with knowledge of the matter. While some firms are avoiding buying for now, they may ultimately have to bow to Beijing’s wishes.

North Asian LNG spot prices surged to a record high this week as importers from China to the UK intensify competition for a shrinking pool of available winter supply. The world is grappling with an energy crisis as the post-pandemic recovery collides with supply restraints, sending fuel and power prices rallying to eye-watering heights.

Many of China’s gas distributors are state-owned, and are used to taking losses buying pricey LNG and selling to domestic consumers at fixed rates. The largest companies are still willing to pay high spot prices to attract shipments away from rivals in Asia and Europe.

But with a single LNG spot cargo currently costing more than $130 million, compared to about $17 million this time last year, the extreme losses are making buyers blanch. Also, some LNG importers have struggled to secure additional loans from banks to make purchases, traders said.

At least two second-tier companies including Shenzhen Energy Group Co. have decided against purchasing shipments because of the high prices, despite the government orders, according to traders. But China’s largest state-owned importers have been busy procuring spot supply.

Representatives at the State Owned Assets Supervision and Administration Commission and Shenzhen Energy Group weren’t immediately available to comment during a public holiday.

The government is trying to make it easier for energy companies to secure loans. Banks and other financial institutions should prioritise lending to qualified mines and power plants so they can increase thermal coal and electricity output, China Banking and Insurance Regulatory Commission said in a statement Tuesday.

Recommended for you

© Supplied by Bloomberg

© Supplied by Bloomberg