Southeast Asia will lead other regions in having the largest share of new deepwater gas and condensate developments taking a final investment decision (FID) between 2022 and 2025, research from Rystad Energy shows. Significantly, around $25 billion is expected to be spent on greenfield deepwater developments in the region from 2021-2025, up from $2 billion over the prior five-year term.

“Nearly 5 billion barrels of oil equivalent (boe) will be sanctioned in Southeast Asia out of a total 22 billion boe globally in the coming four years. Of the 20 or so deepwater projects expected to reach FID through 2025, the top three will be offshore Malaysia, Indonesia, and Vietnam with other developments set to be sanctioned in Thailand, Myanmar, and Brunei,” Rystad said in a report.

“Of Southeast Asia’s total, Indonesia will be responsible for around 60% of these resources followed by Malaysia, Myanmar, Vietnam, and Brunei. A total of over 20 deepwater projects are due for sanctioning by 2025. The top three deepwater projects responsible for nearly 70% of these resources include Chevron’s IDD project in Indonesia, Inpex’s Abadi project in Indonesia and ExxonMobil’s Blue Whale project in Vietnam,” reported the energy consultancy.

Although all three of the top projects face significant challenges that need to be overcome before they can be sanctioned. As a result, timelines for final investment approval are at risk.

“Other projects in the pipeline include Rosmari-Marjoram projects in Malaysia, Kelidang Cluster in Brunei, Kebabangan Phase 2 and Limbayong Phase 2 in Malaysia and Shwe Yee Htun Phase 1 in Myanmar. The majors and internationally focused NOCs operate over 70% of these projects,” said Rystad.

Offshore shelf FIDs

“In terms of offshore shelf resources expected to be sanctioned from 2022-25, Southeast Asia is second to the Middle East with over 3.5 billion boe of resources set for FID. Malaysia will be responsible for nearly 50% of this share followed by Indonesia and Vietnam, with the NOCs the major operators of these projects. PTTEP’s Lang Lebah project in Malaysia is the largest in the list with over 575 million boe of resources set for FID, followed by PetroVietnam’s 560 million boe Block B gas project in Vietnam. Other major projects include the SapuraOMV’s B14 project in Malaysia, Petronas’ K5 and Kasawari Phase 2 projects in Malaysia, Conrad Petroleum’s Mako project in Indonesia and BP’s Vorwata in Indonesia. Chevron’s Ubon in Thailand is also in the pipeline for sanctioning, the first sizeable FID for the nation since 2009,” reported Rystad.

Significant challenges

Offshore developments in Southeast Asia face significant challenges including the high carbon dioxide (CO2) content associated with some of the major field developments. Over 4.5 billion boe of resources with sour gas and high CO2 content are due for FID by 2025, added Rystad. Indeed, many operators, such as Petronas, Inpex, and BP, are considering adding carbon capture, utilisation, and storage (CCUS) to their developments to help reduce their emissions footprint.

“Another potential hurdle for some of the top projects listed is progress on potential unitisation agreements. The Malaysia-Brunei agreement was signed in early 2021, however, the development of the Kelidang cluster is still in the pipeline with little progress yet made,” said Rystad.

Geopolitical tensions could also thwart developments with China staking claim to maritime areas offshore Indonesia, Vietnam and Malaysia, where oil and gas developments are planned.

Beijing officially told Indonesia to stop Harbour’s drilling in South China Sea

Moreover, “in Southeast Asia many of the projects up for sanctioning are also for sale as operators look to either partner up or sell the assets to another company for development. Over 3.5 billion boe of the region’s resources fall into this category, meaning FID timetables could be at risk,” cautioned Rystad.

Shell is seeking to sell its 35% share of the Inpex-operated Abadi project in Indonesia’s Masela Block. Chevron is awaiting the sale of its 62% stake in the IDD project, also in Indonesia, to Eni. While ExxonMobil is seeking buyers for its Blue Whale project in Vietnam.

Despite the hurdles, additional supply from these new developments will be crucial for Southeast Asian countries to offset a significant expected fall in domestic gas production and increased dependence on imports.

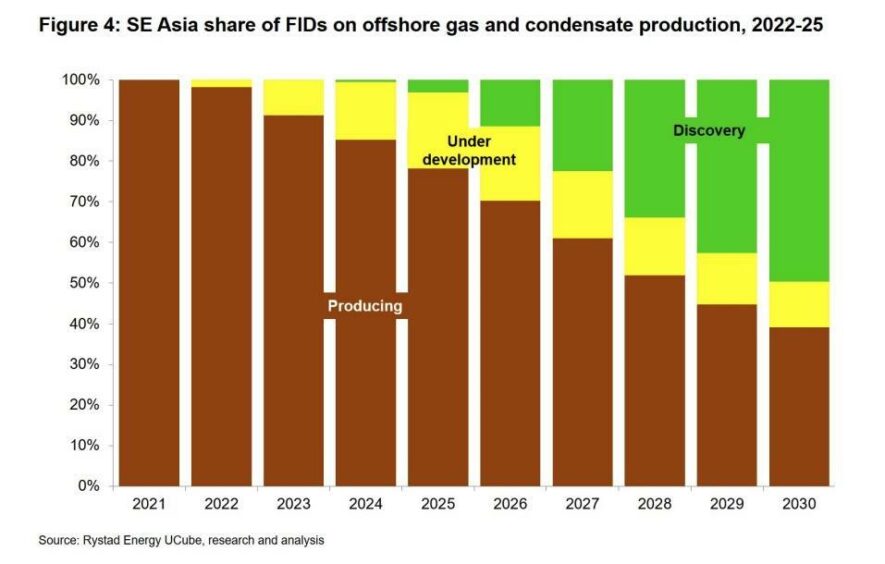

As a result of set-to-be sanctioned deepwater developments, deepwater gas and condensate production in Southeast Asia is predicted to double to around 5 billion cubic feet per day (cf/d) in 2030 compared to current output of about 2.5 billion cf/d, estimates Rystad.

Shelf production in the region from producing fields is set to decline by around 60% from 2021 to 2030. New shelf developments are expected to add around 4.5 billion cf/d of new production by 2030, according to Rystad.