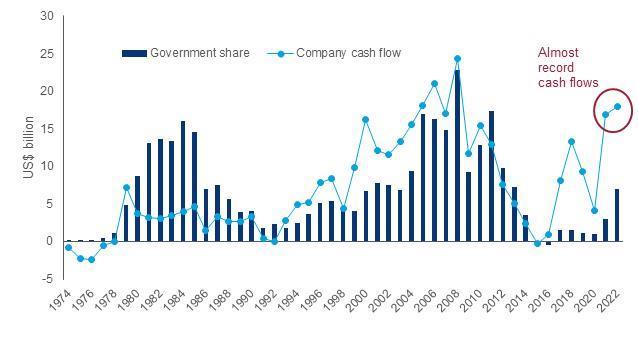

North Sea operators will deliver ‘near-record’ cash margins in 2022, according to Wood Mackenzie, amid higher oil and gas prices and following ‘brutal’ cuts of previous downturns.

North Sea upstream principal analyst Neivan Boroujerdi noted that steady production growth, high prices and ongoing capital discipline would help deliver huge cash margins for the upstream sector next year.

“While investment is set to stay near 20-year lows – and there are question marks over government and E&P appetite for new developments – there could be some smaller project sanctions. We also believe deal flow will pick up, even if regulatory uncertainty in the UK will put downward pressure on valuations,” Mr Boroujerdi added.

Meanwhile, as COP26 and the Glasgow Accord intensify focus on the phase-out and decarbonisation of fossil fuels, the drive to decarbonise offshore operations combined with extensive renewable resources and sustained growth in the low-carbon sector is seeing the emergence of the North Sea as a “global leader,” analysts said.

Added Mr Boroujerdi: “Fiscal changes could become a hot topic. There is high tension between the government’s aspirations to be a net zero leader while still encouraging investment in upstream oil and gas.”

That tension makes for an uneasy investment climate, particularly in light of the environmental opposition to Cambo – which has stalled the project – and the rejection of initial plans for Jackdaw, investors will be scrutinising projects both on their carbon credentials and PR impact.

Analysts said that up to 10 UK projects could be sanctioned next year, as operators make “now or never” decisions. While they said economists would be satisfied with average breakeven prices below $40/bbl, any final investment decisions “will go beyond economics.”

Production

Wood Mackenzie expects UK production to grow slightly to 1.6 million barrels of oil equivalent per day (boepd) next year, buoyed by completed and incoming start-ups at Harbour Energy’s Tolmount, NEO Energy’s Finlaggan and Shell’s Arran and Pierce Depressurisation projects.

Production will also be boosted by the completion of last year’s maintenance on the Forties Pipeline System.

“Amid the uncertainty, we expect companies to book near-record profits next year,” Mr Boroujerdi said.

At the same time, high commodity prices mean operators will likely try to extend field lives where possible. “The savage cost cuts carried out during previous downturns will combine with strong prices to generate cash flow generation levels last seen before the 2008 financial crash. The government could be tempted to boost its revenues,” he added.

“The UK’s track record has been to vary tax rates with prices. Another windfall tax cannot be ruled out. There would be strong resistance from producers, who would typically stop investment in response. But if the government is already considering winding down the sector, this threat may not be as persuasive as it has been in the past.”

The UK’s tensions lie in direct contrast to Norway where it is “full steam ahead.” Up to 25 projects across the Norwegian Continental Shelf (NCS) could get the green light, equating to over $30 billion of future investment.

Norway’s temporary terms – which expire in 12 months – are driving the activity.

Exploration

Mr Boroujerdi said UK exploration activity could double in 2022, albeit from the low levels seen this year. Up to ten prospects are set to be drilled, with Shell operating its highest number of UK wells since 2006.

Planned wells will target up to 1 billion boe, with gas accounting for 80% of prospective resources. In particular, Shell’s high-pressure, high-temperature (HPHT) Edinburgh well in the Central Graben – targeting 388 million boe – is “one of the most exciting wells to be drilled in UK waters in decades,” Wood Mackenzie said.

Drilling will also return to the UK’s west of Shetland after a 2021 hiatus. Total’s 500 billion cubic feet Benriach prospect is close to the Greater Laggan Area.

“But scrutiny will persist on exploration’s role in the energy transition,” Mr Boroujerdi added. “The UK Oil and Gas Authority suspended new licensing in 2021. A permanent suspension remains a – albeit unlikely – possibility.”

M&A

2021 has seen an uptick in M&A deals from a historic low last year, though the bid-ask spread remained wide as rising commodity prices were offset by a backdrop of investor uncertainty. However, $10 billion worth of UK assets are up for sale, making for a strong pipeline of future deals.

Mr Boroujerdi added: “There will be lots of opportunities in the UK. Regulatory uncertainty will put more downward pressure on valuations, which have already traded at discounts in recent years. A thinning list of buyers could see boutique acquirers such as trading houses or new privately-backed management teams plug the gap. Consolidation is likely to be a driver as investors see value in increased scale and operating efficiencies.”

Given several players have also considered potential equity sales, next year may also see the first oil and gas IPO in Europe since 2019, he added.

Doing so will require specific parameters though. “Scale, growth, financial strength and a compelling decarbonisation story will be needed to meet increasingly stringent investment criteria. With long-term commodity price and demand uncertainty, the window of opportunity is narrow and first mover advantage could be key.

“Those unable to access public markets will have to rely on finding buyers. Neptune Energy’s rumoured merger with Harbour Energy could hint at larger regional tie-ups to come,” he explained

Next year will also see an increase in investment in decarbonisation solutions as traditional oil and gas projects face greater scrutiny. Carbon resilience will remain a priority as companies aim to future-proof operations and progress carbon reduction targets.

Meanwhile, the UK government will finalise commercial frameworks for CCS next year, while the operators of the UK’s Track 1 projects will work towards gaining storage permits.

This will make for “a big year” for blue hydrogen as well, where developments such as Equinor’s H2H Saltend and Kellas Midstream’s H2NorthEast, will be progressed alongside CCS schemes.

Recommended for you

© Supplied by Wood Mackenzie

© Supplied by Wood Mackenzie