Weatherford International’s chief executive has resigned just days before the struggling oil-field services company’s annual meeting and amid a debt crisis that could lead to a second bankruptcy filing in less than a year.

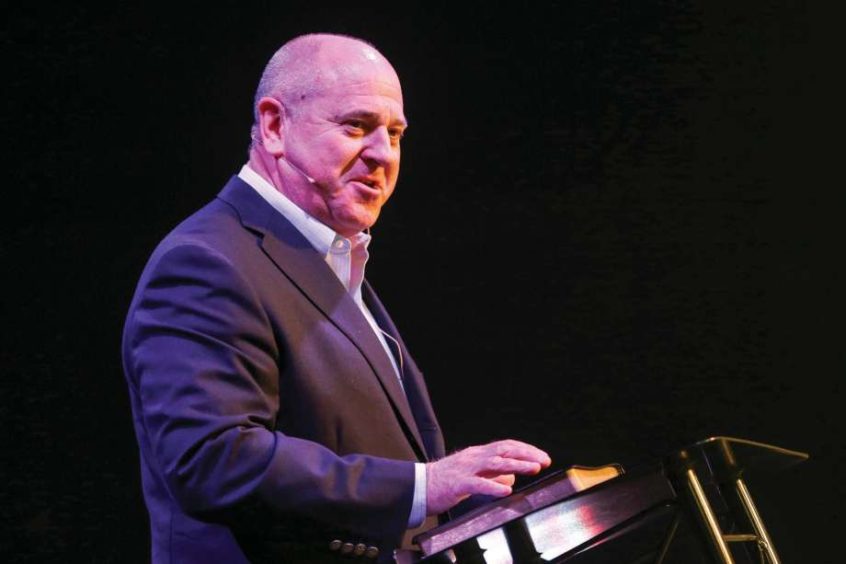

Mark McCollum resigned Sunday, the company said Monday, and COO Karl Blanchard and CFO Christian Garcia will oversee operations during a search for McCollum’s replacement.

Garcia told investors Monday that McCollum’s departure was “not the result of any dispute or disagreement with the company on any matter relating to the company’s accounting practices or financial statements.”

His exit, however, comes days ahead of Weatherford’s June 12 annual meeting and as a recent filing with the Securities and Exchange Commission reveals that the oil crash created a financial crisis that could lead to the company defaulting on debts and filing for bankruptcy.

“The problem is that Weatherford emerged from bankruptcy at the wrong time with too much debt,” said Sarah Foss, a Houston-based legal analyst with the London financial news service Debtwire. “They left bankruptcy with $2.7 billion of debt. They shed $6.7 billion of debt. That’s impressive but they didn’t anticipate the things that are happening now.”

McCollum left an executive position at competitor Halliburton to join Weatherford as CEO in March 2017 as the industry was coming out of the 2014-16 oil downturn. Weatherford, which had racked up $10 billion in debt, went more than four years without making a profit and declared Chapter 11 bankruptcy in July 2019.

The company, which is based in Switzerland with principal offices in Houston, emerged from bankruptcy in December and lost $966 million in the first-quarter as a price war between Russia and Saudi Arabia and the coronavirus pandemic began to crush crude prices.

“Weatherford delivered materially improved performance this year until the onset of the COVID-19 pandemic and actions by certain oil producing nations created unprecedented uncertainty in the energy and other markets,” Weatherford board Chairman Thomas Bates said. “We will continue to focus our efforts on reducing costs and managing liquidity in the face of this challenging business environment.”

Although the company reported $950 million in cash and available credit at the end of the first quarter, Weatherford had a large debt payment and interest payment due on June 1, Foss said.

Weatherford said it made the June payments, but the company recently retained bankruptcy and restructuring law firm Paul Weiss, according to Foss.

The company’s options, she said, include renegotiating payments and credit agreements with lenders or to file a second Chapter 11 bankruptcy.

Some lenders are already showing signs of impatience. New York investment management firm and activist investor D.E. Shaw Group, a bondholder and large Weatherford shareholder, is seeking to unseat three board members at the company’s annual meeting Friday.

Weatherford might also be in jeopardy of violating financial covenants in which a company agrees to keep to a certain amount of cash on hand and debts below certain levels, said Craig Pirrong, a finance professor with the University of Houston Bauer College of Business.

Companies sometimes pay off debt in stock, but a second bankruptcy wouldn’t be unheard of if they face violating potential financial agreements with its investors and lenders, Pirrong said.

Weatherford could be “in violation of these covenants, which would give the lenders the ability to force the company into default and/or bankruptcy,” Pirrong said. “That’s an unpleasant option that both the borrower and lenders want to avoid, so the company and some of its lenders are negotiating to restructure the transactions.”

This article first appeared on the Houston Chronicle – an Energy Voice content partner. For more from the Houston Chronicle click here.