Oil prices could nearly double by the summer if more countries follow suit in banning Russian oil imports, analysts have forecast.

Commodity prices spiked again yesterday in the wake of decisions by the UK and US to cease Russian energy imports, with benchmark Brent crude jumping $5 per barrel following the news.

In an extraordinary note released today, Rystad Energy’s head of oil markets, Bjørnar Tonhaugen said a worst-case scenario could see oil prices hit $240 per barrel this summer, if more Western countries follow the precedent set by the UK and US.

“Market volatility is at an all-time high, with prices surging on the expectation that supply will further tighten due to restrictive sanctions on Russian energy from the West,” he noted.

Mr Tonhaugen said traders, analysts and lawmakers should all prepare for prolonged, elevated prices, based on current forecasts.

“This is the largest energy crisis in decades and the impact on the world’s most important commodity is going to be unprecedented. If more Western countries join the US and impose oil embargoes on Russia, it would create a 4.3 million barrel per day (bpd) hole in the market that simply cannot be quickly replaced by other sources of supply,” he continued.

Rystad says that prices must rise enough to destroy demand and incentivise a supply response via higher activity, though both will take several months.

“If 4.3 million bpd of Russian oil exports to the “West” are halted by April 2022, and where China and India only keep current import levels intact, Brent would need to spike to $240 per barrel by the summer of 2022 to destroy demand,” Mr Tonhaugen said.

“This collapse would be the largest potential oil supply shortage since the 1990 Gulf War, when oil prices doubled.”

However, the more prices rise, the greater the chances of the global economy entering a recession in the fourth quarter of 2022.

UK ‘phase out’

The points were echoed by Michael Burns, energy partner at law firm Ashurst. Commenting on the UK’s decision to ‘phase out’ Russian oil by the end of the year, Mr Burns noted that although the UK only imports around 8% of its oil requirements from Russia, the embargo belies a larger issue.

“Oil and gas pricing is part of a global market and so the simple fact is that where restrictions are placed on where oil and gas can be purchased from, the demand-side is left with a reduced source of supply that it has access to.

“That means that prices for non-Russian product (whether directly or indirect through the spot market) increase and those that have to replace Russian supplies will be exposed to those higher prices, as well as those looking to make purchases in that higher-priced market.

“That is the broader concern: the impacts of supply have global effects on pricing,” he added.

Deirdre Michie, CEO of offshore trade body Offshore Energies UK (OEUK) said the sector had “reiterated its commitment” to working with Government to ensure the security of UK energy supplies.

“The UK has diverse, secure, and reliance energy sources with the majority of it coming from domestic production and pipelined supply from Norway. We continue to work with the government and our members to see how we can build on this reliable energy base while continue to rapidly accelerate the transition to cleaner energies.

Ms Michie said the organisation would consider the UK government’s proposals in more detail over the coming days.

EU block

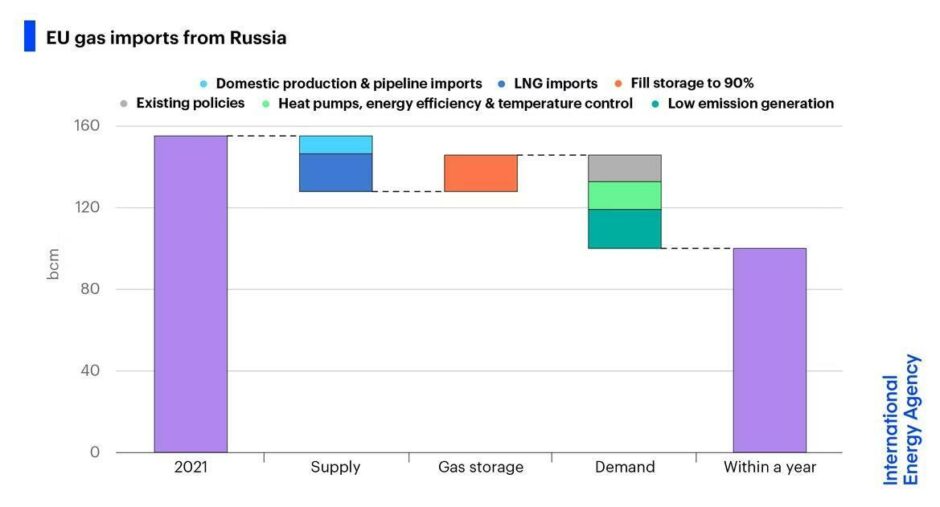

At the same time, the EU proposed its REPowerEU plan, aiming to remove at least 155 billion cubic metres of gas consumption, equivalent to the amount imported by the EU from Russia in 2021.

The European Commission said yesterday that it would aim to achieve two-thirds of this amount within a year.

The action was also the subject of an International Energy Agency paper last week, recommending similar measures.

In addition, the EU sanctioned the potential imposition of windfall taxes on energy to offset rising bills.

Ashley Kelty, senior research analyst for oil and gas at investment bank Panmure Gordon, said this would in fact “disincentivise” energy companies from investing in securing necessary supplies to meet medium term demand growth.

“We doubt that the EU will be able to secure such supplies, and if it can, it will need to outbid other buyers around the globe,” he noted.

The EU also proposed rules that would require countries to fill gas storage to 90% by October 1 each year.

“This is in theory a good idea,” Mr Kelty added, “But the unintended effect will be to smooth the forward curve to reduce seasonality effects – except just at a higher level all year round.”

“This package of measures are well intentioned, but the Eurocrats in the ivory towers of Brussels don’t appear to realise that this will just ensure that prices continue to remain high for both industrial and domestic consumers across the bloc, and may not deliver the populist benefits that politicians crave.”

© Supplied by IEA

© Supplied by IEA