The Orange Basin is at the heart of Eco Atlantic’s plans. Where TotalEnergies and Shell have made finds in Namibia’s part of the basin, Eco has its focus on Block 3B/4B, over the border in South Africa.

“We have a very strategic position in the basin,” Eco CEO Gil Holzman said this week. “Block 3B/4B is exactly on trend with Graff and Venus”, Shell and Total’s finds respectively. The two majors are drilling at the moment, with the French company having brought in a second rig recently.

Bright Orange

Africa Oil is the operator of the block, with a 20% stake. Eco has a stake via Azinam, with 26.25%, while Ricocure has 53.75%. The licence is big, covering 17,581 square km, with a recent report giving a P50 resource of just over 3 billion barrels.

The plan is to farm out a stake in the licence and then begin drilling.

“The entire area is very active with people looking for acreage, there’s a keen interest, more than eight companies have approached us for access to our data room,” Holzman said. “We are here to drill exploration wells and we are getting closer.”

The partners have an environmental impact assessment (EIA) process under way for exploration on the block. The EIA is initially for one well, with a follow up appraisal or more exploration. The application would cover up to five wells on the area.

“We have the targets identified. Hopefully we will start drilling in 2024, with targets in different ages,” Holzman said.

Shell and Total each have 40% stakes in Block 5/6/7, to the south of Block 3B/4B. The French company has applied for authorisation to begin drilling up to five blocks on the licence, potentially starting late this year.

Total has also recently launched an EIA process on its 12/3/343 ER licence, also known as the Deep Water Orange Basin (DWOB). Under this, it could drill up to 10 wells in the area, starting in 2024.

Offshore challenge

Working offshore South Africa has drawn its share of criticism. Local NGOs have fought every plan, arguing in court that companies have failed to take into account the desires of local communities.

“We have proven that we can effectively communicate with local communities and organisations,” Holzman said. Eco, as operator, safely drilled a well in late 2022 on Block 2B. The well failed to make a commercial find, but drilling went off without a hitch.

“The NGOs are primarily focused on opposing seismic. Drilling creates an extremely small footprint and we and others have proven with international safety protocols that this can be done safely and at low risk,” Holzman said.

“We came in with a state-of-the-art automated rig and engineered the well with redundant safety systems and industry leading operating protocols – the Gazania-1 well was drilled safely and soundly,” he said.

“I’m a keen surfer, and protective of the environment, I will protect any beach in the world, but a country should take care first and foremost of its own citizens and their wellbeing.”

Civil society throws up challenges for the operator, but “we take seriously the responsibility for countries to govern their own affairs and not be directed by external NGOs and organisations with their own agenda.

Petroleum Agency South Africa (PASA), the Department of Mineral Resources and Energy (DMRE), the government, “they understand South Africa must continue encouraging investment in order to go through the just sustainable transition.”

Despite the challenges, Holzman was enthusiastic about South Africa’s prospects. The country has 70% of the Orange Basin, he noted, with oil underground irrespective of the border.

“The energy challenges of South Africa are significant – and resolving them will take a consorted and balanced effort for energy development, including both hydrocarbon and renewable energy alternatives.”

Next for Gazania

As Holzman noted, Eco was a partner in the Gazania well on Block 2B last year, offshore South Africa. The well failed and two partners, Crown Energy and Africa Energy recently pulled out.

Eco, though, is staying the course. The block holds a light oil discovery, of around 40 million barrels. While this is not enough to be commercial on its own, adding another find would change the story.

As such, the remaining partners – Eco and Panoro – are applying for a production right on the area. The group has met all its exploration requirements, Holzman noted. There is a moratorium on new exploration licences.

A production licence would give the companies time to continue their analysis and their next steps – in addition to working out the joint venture’s structure.

Beyond South Africa

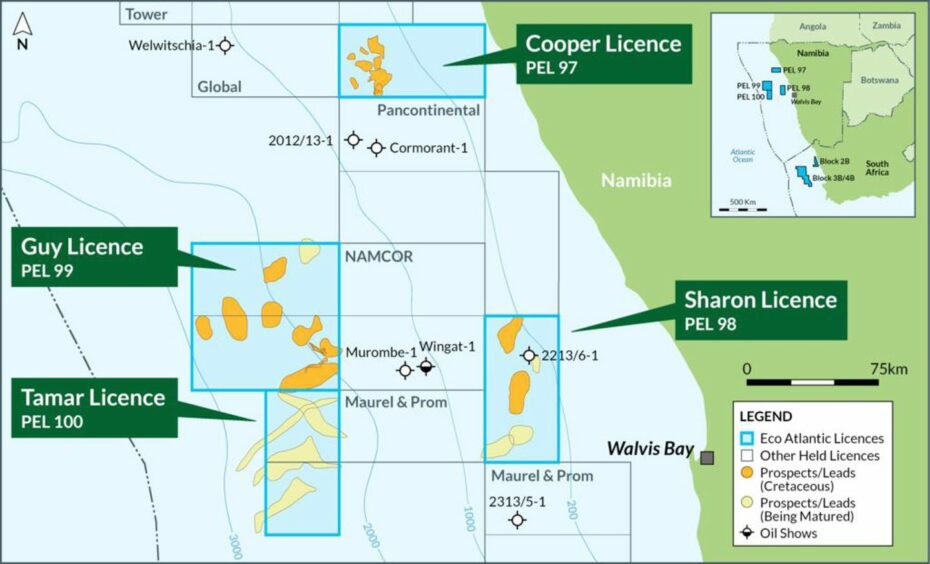

Eco also has four blocks in Namibia’s Walvis Basin and a stake in the Orinduik block, offshore Guyana.

No commercial finds have been made in the Walvis Basin yet, although oil was recovered to surface at a well in 2013.

“The Walvis Basin has a future, with areas in the west the most attractive, since companies like Total and Shell have proved the technology to drill in that water depth,” the Eco executive said. The company is in talks with a number of companies around bringing a partner in, although it is not in an official farm-out process.

“We have been in Namibia since 2009 and met all our work obligations. We have four blocks, one of the largest acreage holdings in the country. Namibia is a great place to work and the geology – even outside the Orange Basin – is very attractive.”

Guyana, too, is reliant on third parties for progress. The partners discovered heavy oil on the licence in 2019. “Tullow Oil has decided not to develop it, we were keen to enter the next exploration phase with drilling as soon as 2024. But Tullow is no longer an exploration company, it’s only focus is on Ghana.”

As a result, there is a “bottleneck” for development at Orinduik. Eco, Holzman said, is finding ways to restructure the joint venture. “Until the Tullow problem is solved, we are stuck.”

Eco is working on two potential deals, one corporate, one asset based, in areas the company is already working in, the CEO said. It aims to seal one deal this year.

The company would prefer to bring in a partner and then drill, rather than raise cash for drilling itself. “It can be done, but it’s not preferred. We are looking for asset deals in Block 3B/4B and Namibia, and some sort of a solution in Guyana. Then we can drill two or three wells in 2024, in South Africa and Guyana.”

Recommended for you

© Supplied by Eco Atlantic

© Supplied by Eco Atlantic © Supplied by Eco Atlantic

© Supplied by Eco Atlantic © Supplied by Eco Atlantic

© Supplied by Eco Atlantic