With oil consistently above the $100/barrel threshold, demand for rigs is set to continue its ramp up, with the North and Barents Seas marked as hotspots, according to data from rig analysts Esgian.

While offshore rig contractors are not expecting an immediate boom, analysts suggest that E&P companies are now making “near-to-medium term plans” based on Brent crude at $80/barrel, driving further demand for rigs.

Esgian Rig Analytics reports that competitive utilisation for March 2022 stood at 73%, while a number of future commitments in the pipeline are likely to push this even higher.

In a recent blog, head of rig market research Cinnamon Edralin writes that this has already improved utilisation rates for drillships in South America and the US Gulf of Mexico and jackups in the Middle East.

However, the North Sea/Barents region was marked as a particular area of activity, with E&Ps focused on near-field opportunities to support energy security and leverage the current high price environment.

Esgian said eight drilling campaigns, with start dates out to 2024, are currently in the pre-tender or tender stage in the region, while another 26 programmes are in the planning phase and could progress to tenders.

In December, Esgian noted that the region’s rig market was very tight, with the UK having a “very limited” supply of semi-subs in particular.

Analyst Terrsa Wilkie said that “it really wouldn’t take much for that market to sell out,” if activity was to suddenly increase, and with known projects alone, utilisation of semi-subs could reach 85%.

Senior rig analyst Sarah McLean confirmed this week that there had been an uptick in semi-sub demand and competitive utilisation rates were expected to see “sustained growth” through Q3 2022 and 2023.

“With a number of older semis having left the North Sea market since 2020, and also some units securing work outside the UK, this will all add to the tightening of supply. As such, and in line with the rest of the global markets, this will lead to continued upward pressure on dayrates,” Ms McLean added.

Projects revisited

Ms Edralin said shelved projects may be revisited in light of the increased focus on energy security. Esgian pointed to developments such as the Cambo field west of Shetland in particular.

This week partners Siccar Point Energy and Shell were granted a two-year extension to the licences, while Shell was said to be “mapping out next steps”, having decided in December not to move it forward to a final investment decision, citing the project economics.

She also pointed to activity off West Africa, where TotalEnergies last month announced a “significant discovery” at its Venus prospect, judged by observers to be one of the largest in sub-Saharan Africa.

Australia too may see a rise in drilling, with three programmes in the pre-tender or tender phase with target start dates out to 2024, and nearly 20 more programmes planned for the same timeframe – a considerable spread for a “relatively small” market.

However, she also cautioned that: “Some projects may be delayed or canceled due to reasons such as, but not limited to, rising day rates, lack of suitable rig availability, the changing focus of many E&Ps in light of ESG concerns, or even a lack of financing or partner approval.”

Recommended for you

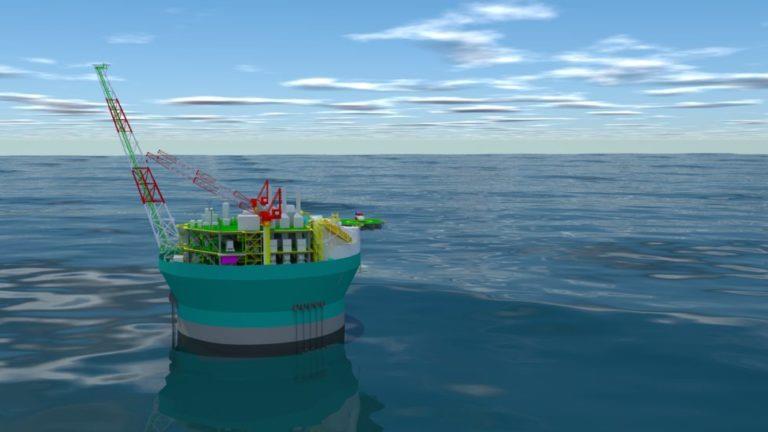

© Supplied by Sevan SSP/ Sembcorp

© Supplied by Sevan SSP/ Sembcorp