China’s long-awaited national carbon market is set to miss a government target to begin by the end of June, a new set-back to plans to create the world’s largest emissions trading system.

It’s unclear when the market will begin operating, a spokesperson with the Shanghai Environment and Energy Exchange, which will host trading, said Monday. Minister of Ecology and Environment Huang Runqiu had said in February that he wanted the first trades to commence by the end of June.

Trading won’t now happen until after July 1 because of a lack of organization, according to a person familiar with its development. It’s unclear how long the start will be delayed, according to the person, who asked not to be identified discussing private information.

The Ministry of Ecology and Environment, which oversees the carbon market, didn’t respond to a faxed request for comment. “We progress our work on the arrangements of the higher authorities and departments,” the Shanghai exchange spokesperson said.

It isn’t the first time the launch has been delayed. China’s government had previously set itself a deadline to launch by the end of 2020 until plans were disrupted by the pandemic. There are also concerns it could be years before the system delivers meaningful impact, with generous carbon emissions allocations unlikely to spur quick action to curb pollution.

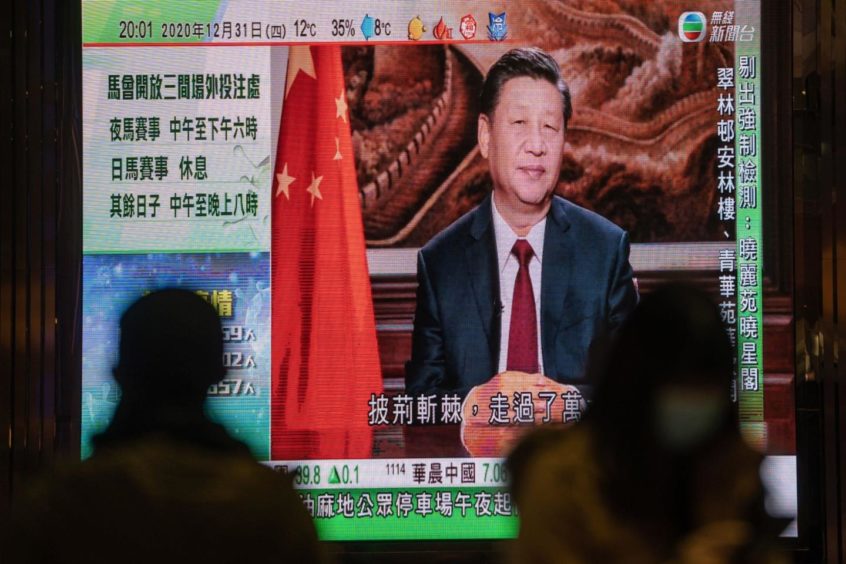

The market is intended to be another tool President Xi Jinping can use to help meet China’s goal of hitting peak emissions by 2030 and carbon neutrality by 2060. Trade on the bourse could be worth $800 million annually at the start and expand more than 30-fold over the next decade, according to Citigroup Inc.

China’s system is intended to force companies to pay for at least some permits to release carbon dioxide, encouraging them to use fuel more efficiently and reduce pollution. Those that fail to do so could be fined or will need to pay for more permits to pollute. Companies that quickly cut emissions will be able to sell spare allowances for profit.

Rules guiding the market became official on Feb. 1. Last week, the Shanghai exchange said listed transactions will be for 100,000 tons of carbon dioxide equivalent or less, and price moves will be within 10% of the prior day’s close. Larger block trades will be able to move prices by 30%.

The system will initially cover more than 2,200 companies in China’s power sector, which account for about half of the emissions in the world’s biggest polluter. It’ll eventually grow to encompass more industries, such as steel- and cement-makers.

Recommended for you