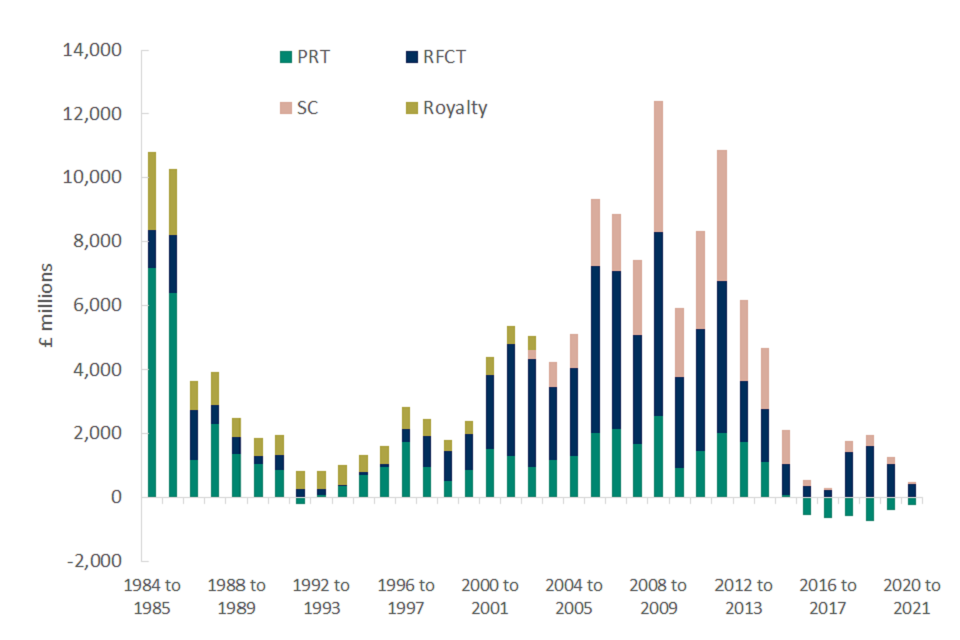

UK government revenues from oil and gas taxes have plummeted by more than 70% due to effects of the recent price crash and decommissioning repayments.

Total government revenues from production were £248million in the 2020 financial year, down from £900m in the previous period, according to HMRC.

2020 was the worst year since 2016 for government revenues, which saw losses of £400million as knock-on effect of the 2014 downturn.

International benchmark Brent crude plunged to a 21-year low in April 2020, while West Texas Intermediate in the US went into negative value.

The reduced fuel demand played a major role on the Exchequer’s receipts.

Petroleum economist professor Alex Kemp of Aberdeen University said the results “are not unexpected”, adding that even with the oil price rebounding to around $70 in recent months, the Treasury “shouldn’t expect any bonanzas”.

“At that level, we would expect some new investments to go ahead but that would mean they carry capital allowances against taxable income, which would mean that even with some increase in investment over the next year or so, the tax revenues wouldn’t bounce up very strongly.”

The impact of decommissioning spending, which reduces profits and therefore the tax take, is also playing a part, as well as government repayments on decom.

Although the industry has paid over £350billion in taxes to date, HMRC has estimated that the cost of decom rebates will cost the Treasury around £18.3bn by 2065.

Such repayments dented receipts of Petroleum Revenue Tax, which have been negative since the rate was set to zero in 2016, as well as corporation tax in 2020.

Unlike Denmark, which offers rebates on decom throughout a field’s production life, the UK only offers the tax relief once a field’s production ends, meaning the sums can go back years.

Campaign groups such as Uplift, which backs the Paid to Pollute activist movement, have argued the money should instead be funneled into projects to train workers for renewables.

Academics and industry figures have said it is a “legitimate cost of doing business” and that “moving the goal posts” could damage trust between government and major industries including renewables.

UK legislation means partner firms or previous owners of oil fields will have to pay decommissioning bills if the current owner fails to do so, with the final step on the ladder being the UK government.

Revenues from oil and gas reached a peak in the 2008 financial year at more than £12billion and have generally declined ever since.

In 2020 expenditure in the North Sea was less than 50% of that seen during the peak year of 2014.

Recommended for you

© UK Government

© UK Government