“Although we’ve had some massive successes and a number of projects have been able to get out of the blocks, deployment of offshore wind in Scotland has been slow,” says Adam Morrison, head of Ocean Wind’s (OW) Moray West Offshore Wind Farm.

By the end of the decade, Holyrood hopes to have 11 gigawatts (GW) of offshore wind capacity installed in Scottish waters.

As it stands, Scotland has around 900 megawatts (MW) of operational offshore wind and although a number of new projects are under construction, including OW’s Moray East development, there is still a significant gulf that needs to be overcome.

And “fundamental basic issues” that projects north of the border have to contend with is going to make hitting those goals even harder, says Morrison.

He said: “The central problem is securing a route to market and making an investment case in order to move forward, rather than securing planning permission.

“The most important thing is getting sites into the hands of developers, which is where ScotWind is hugely important, and ensuring they’re able to compete.”

OW’s Moray West project, earmarked for the outer Moray Firth, is currently awaiting a Contracts for Difference (CfD) award, having secured planning consent in 2019.

However, the development, along with others in Scotland, faces two “big competitive hurdles” to getting off the ground.

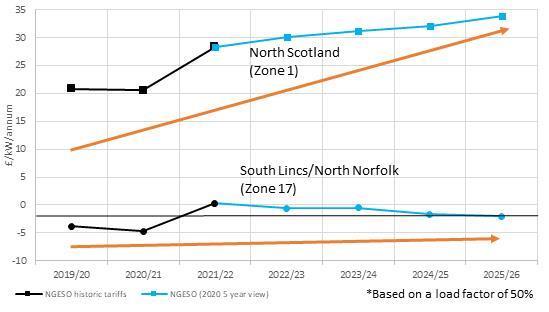

Morrison said: “From the perspective of our portfolio, transmission losses, which we pay very steeply for, and transmission charges are the two biggest barriers we face.

“Locational transmission losses are a relatively new evolution and entail losses being applied to metered energy based on where it’s generated to where it’s demanded. That means we’ve got around 5% being removed from our produced volumes – that more than offsets Scotland’s better wind resources.

“Then you face the double whammy of paying very amplified, very volatile transmission. It’s basically the same effect; there’s distance from generation to demand and we northern generators are penalised for that based on the way grid charges are calculated.

“The combined effect of the two is the most significant barrier to offshore wind deployment by a very long way indeed.”

Morrison, who is also chairman of trade body Scottish Renewables’, added that the combination of a “rapidly changing” energy market and a “complex charging model” means that defects are bound to crop up.

So far, a “series of sticking plasters” have been implemented in an effort to address the obstacles to deployment.

But, Morrison said the changes “haven’t delivered any sort of stability whatsoever”.

He added: “For existing projects, it exposes them to dramatically increasing charges that they’ve got no way of mitigating at all – that’s very damaging to investor confidence.

“In the case of new assets, it sends a strong signal against them being deployed. Moving forward, we need significant generation in Scotland to meet our targets. But, at the moment we’re exposing them to significant costs and massive uncertainty.”

To ensure that offshore wind developers are given the certainty needed to green light projects, Morrison said a “substantive reform” of electricity transmission charging is required.

In some regards, offshore renewables has become a victim of its own success, outstripping regulations that were “designed for a world of fossil fuel generation”.

This calls for “urgent stabilisation and intervention” by Westminster or the regulator in order to provide steadiness for developers, Morrison said.

He concluded: “Uncertainty is sometimes seen as being a natural problem for developers, one that they need to learn to live with. The reality is that uncertainty costs money and that can flow to the consumer. There’s a very strong case for some short term, urgent intervention.

“In the long term, and I think this point is acknowledged now, we need substantive reform of how our networks are charged in order to deliver something that’s compatible with net zero and the rapidly changing nature of our energy market.”

Edinburgh-headquartered Ocean Winds is a joint venture, owned and created by Madrid-based EDP Renewables and French utility Engie in 2020. It currently has 1.9 GW of offshore wind under development and construction in Scotland.

Recommended for you

© Supplied by Ocean Winds

© Supplied by Ocean Winds © Supplied by Ocean Winds

© Supplied by Ocean Winds