A host of North Sea environmental statements (ES), lodged between April and August, are still to be rubber stamped, with some expected to receive sign off before the year is out.

With Europe crying out for more oil and gas to ease supply woes, operators cracked on with tabling compulsory paperwork in a bid to get their projects heading in the right direction.

Among the ES awaiting the green lights are Equinor’s (OSLO: EQNR) Rosebank field, BP’s (LON: BP) Murlach project, and Harbour Energy’s (LON: HBR) Talbot scheme.

In a bid to replace Russian imports, the UK Government laid down the gauntlet to the North Sea to boost production to share up domestic energy supplies.

Plans were put in place to streamline a number of projects – some of which had appeared to have stalled – and others – that looked dead in the water – were given fresh impetus.

At the start of 2022, research body Westwood Global Energy Group “expected an improvement on the two greenfield developments sanctioned in 2021”, tipping eight field sanctions in 2022.

But a handful of projects – including IOG’s (LON: IOG) Goddard, Repsol Sinopec’s Tain, and Harbour’s Mongour – have been kicked down the road.

Westwood now predicts just five new developments to be sanctioned this year, with three forecast still to come, though they could slip.

Of the two projects sanctioned to date in 2022, Ithaca Energy’s (LON: ITH) Abigail and Shell’s (LON: SHEL) Jackdaw, both were submitted to authorities in 2021.

As it stands, seven ES submitted to BEIS for review between April and August 2022 are awaiting approval, but Westwood notes that “the duration of the review process varies significantly”.

Yvonne Telford, research director at the organisation, said: “Westwood analysis, conducted in September 2022, reviewed a dataset of 47 ES submissions since 2009.

“There was no indication that ES reviews now take longer to review and approve, compared to earlier years.

“Standalone developments, via an FPSO or new-build platform, were found to have average approval times of 325 and 296 days respectively, which are, as expected, higher than the 176 day average for subsea developments.

“For this reason, the timing of the remaining three expected field sanctions in 2022 could be at risk and slip to 2023.”

The Magnificent Seven

Rosebank

Equinor submitted its ES for the £8.1 billion Rosebank project to Westminster in August – documents were subsequently removed from the government website, but not before Energy Voice had seen and saved them.

It followed recent speculation that the Norwegian energy giant was toying with walking away from the scheme, which has proved a tough nut to crack.

Among the largest untapped resources in the UK North Sea, it will be developed using the Knarr FPSO, with first oil targeted at the end of 2026.

According to some estimates, Rosebank contains around 300 million barrels of oil recoverable.

Talbot

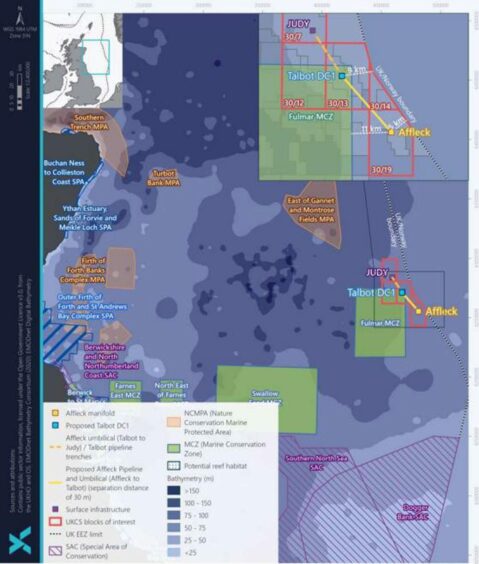

Harbour submitted an ES for its proposed Talbot subsea development in June, with a view to reaching first oil in Q3 2024.

It is located around 170 miles south east of Peterhead, and a few miles west of the UK/ Norway median line, with recoverable estimates placed at around 18.1m barrels of oil equivalent (boe) of light oil with associated gas.

Production will be tied back to Harbour’s Judy platform, with oil being exported to Teesside.

Harbour holds a 67% operated interest in the field, while Eni holds the remaining 33% equity interest.

Affleck redevelopment

NEO Energy took 100% ownership of the Affleck field, 178 miles south-east of Aberdeen, last year.

It plans to revamp existing wells and tie them back to a manifold, also connected to Judy, via the Talbot field.

First oil is on the slate for 2024, with production tipped to peak at 5,218 barrels of oil in 2025.

Captain EOR, Stage 2, Phase II

Emerging North Sea heavyweight Ithaca is planning to drill seven new wells at the Captain field, 90 miles east of Aberdeen.

The £400m enhanced oil recovery (EOR) programme is the latest step in a long-running life extension project dating back to the last decade.

The first phase of the EOR project was sanctioned by then-operator Chevron in October 2017, with the aim of boosting recovery by 5-7%.

According to the ES, six new subsea polymer injection wells will be drilled across two new drill centres starting next year, while one further production well will also be drilled at an existing site.

Victory

Corallian Energy lodged paperwork for the West of Shetland, Victory scheme, estimated to hold mid-case recoverable resources of 179 billion cubic feet of gas (bcf), in July.

At the time, Reabold Resources (LON: RBD), majority owner of Corallian, was in discussions to sell the business to an unnamed company, later revealed to be Shell.

Earlier this month the oil giant completed the takeover of the company, as well as Victory, which may be developed as a tieback to TotalEnergies’ (LON: TTE) Laggan-Tormore pipeline, previously the preferred option.

Teal West

Hibiscus Petroleum (KLSE: HIBISCS) is pushing on with a three stage development of the Teal West project.

In its ES, the Malaysia-owned operator said the four million-barrel development would “contribute to the national need for hydrocarbon production in the short term” for the UK.

Teal West is expected to have a production life of 10 years and, in the high production case, reach a total of 10.4m stock tank barrels of oil and 9.8 bcf.

It is planned over three stages as a tie-back to the Anasuria FPSO, with two production wells and a single water injection well.

Murlach

Oil giant BP announced earlier this year it is pressing ahead with plans to develop the Murlach oil and gas field.

The project is expected to recover 25.9m boe and 602m cubic metres of gas, produced through a two-well tie-back to the ETAP production hub.

Murlach is a redevelopment of the Skua field which was in production in the early 2000s, then operated by Shell.

You can read more from Ms Telford, as well as number of other analysts, in Energy Voice’s 2023 North Sea forecast, included in next week’s supplement.

Recommended for you

© Supplied by AJL

© Supplied by AJL © Supplied by Altera Infrastructur

© Supplied by Altera Infrastructur © Supplied by Harbour Energy

© Supplied by Harbour Energy © Supplied by NEO

© Supplied by NEO

© Bloomberg

© Bloomberg